The framework serves as a cornerstone of the United Arab Emirates' (“UAE”) ‘Net Zero by 2050’ strategy and enhances a series of regulatory initiatives in sustainable finance led by a multisectoral effort, encapsulated within the Sustainable Finance Working Group (“SFWG”). Thus, the framework is part of the wider ‘Sustainable Finance Regulatory Framework’ (July 2023), which also encompass rules on sustainability-oriented investment funds, managed portfolios, and bonds, along with the recently released ‘Principles for Sustainability-Related Disclosures for Reporting Entities’ (June 2024).

ADGM’s ESG Disclosures Framework

08 July 2024

Nicole Balarezo Urteaga, Associate

In June 2023, the Abu Dhabi Global Market (“ADGM”), the financial regulator of the United Arab Emirates, published its ESG Disclosures Framework. Through this regulation, ADGM introduced reporting requirements for environmental, social, and governance (“ESG”) information for certain companies and financial institutions registered in this financial hub.

In-scope entities: Companies, fund and asset managers

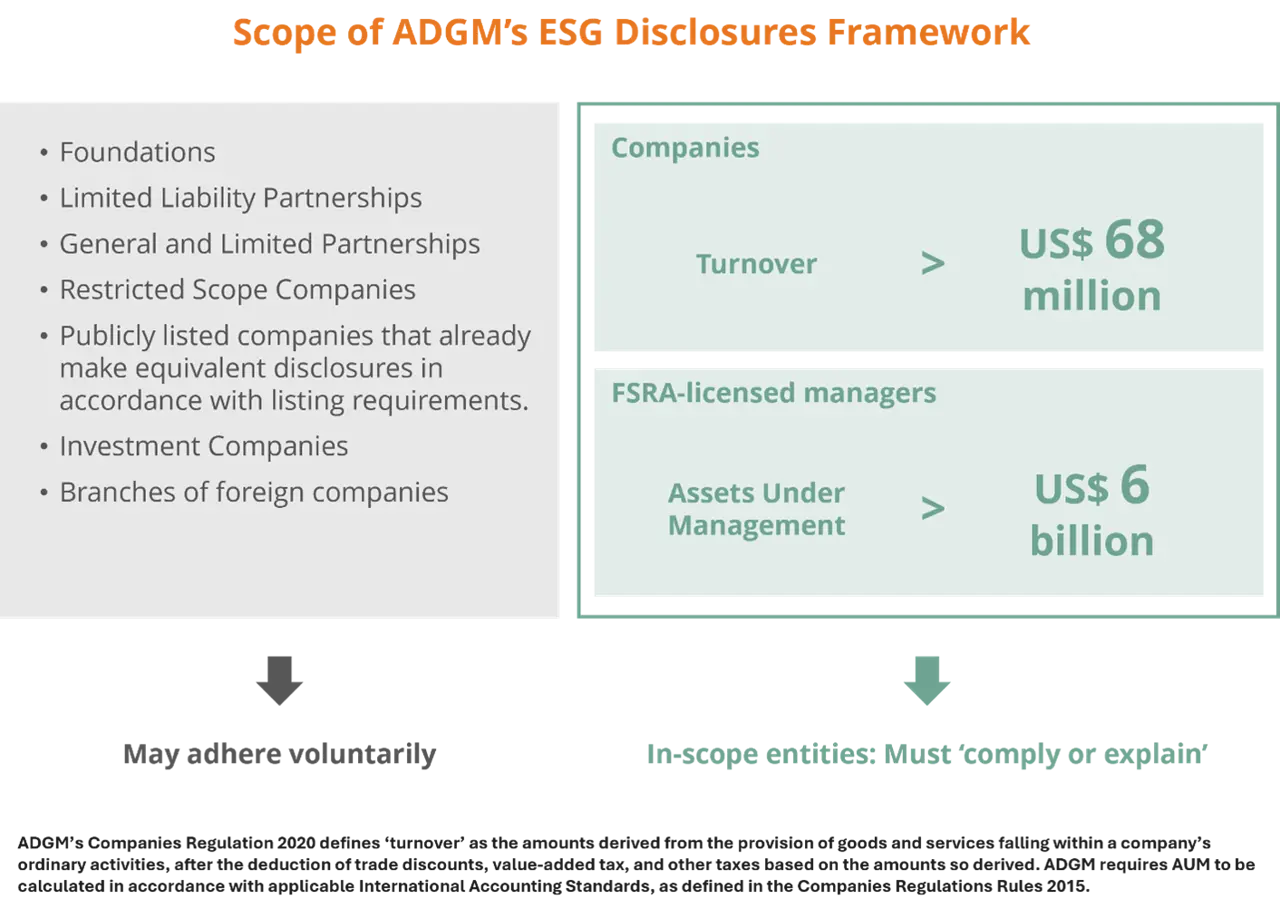

ADGM’s ESG Disclosure Framework applies to a set of in-scope companies that exceed either of the following thresholds:

- companies with a turnover of more than US$68 million, or

- FSRA licensed fund and asset managers with Assets Under Management (“AUM”) exceeding US$6 billion.

These entities are now required to comply with the framework in the third year following its incorporation or continuance into ADGM, which means that many companies are already required to comply. Additionally, other not in scope ADGM registrants may adhere voluntarily.

For companies that meet the turnover threshold, disclosure expectations encompass relevant information about their sustainability policies, practices, performance, and financially material sustainability risks and opportunities. FSRA-licensed managers, meanwhile, are required to provide entity-level disclosures on how they integrate ESG-related risks and opportunities into their asset management and administration on behalf of clients. Submissions will need to be prepared in attention to globally recognized standards.

A flexible approach: ‘Comply or explain’

In establishing this regime, ADGM aims to introduce a flexible framework, designed to enable in-scope companies to implement the necessary governance processes for effective information reporting. Under this 'comply or explain' scheme, in-scope companies may choose not to make ESG disclosures, provided they promptly inform ADGM of their decision, and clearly explain the rationale behind it.

In a context where reputational risks associated with the omission of ESG-related information or the disclosure of inaccurate information increasingly affect corporate and financial entities, the decision to comply or to explain the choice not to report becomes particularly sensitive. For this reason, at Holtara, we are prepared to assist our clients in this process, ensuring that, while this flexibility exists, in-scope entities maintain effective communication with the relevant authorities and lay the groundwork to navigate a potentially mandatory framework in the future.

A variety of options: Globally recognised standards

Unlike other regions that have opted to tie their ESG disclosure obligations to specific standards (e.g., Brazil’s full embrace of ISSB), ADGM’s reporting requirements are comparatively less categorical. They allow submissions to be prepared in line with standards deemed most reasonable by each company, provided those standards are globally accepted. ADGM mentions CDP, GRI, Higg Index, ISSB, TCFD, and UNSDG as examples of these global standards.

It's important to note, however, that flexibility can also come with a burden, as each of these standards fosters its own set of objectives, metrics, and reporting systems. Consequently, in-scope entities will face the daunting task of selecting a standard that aligns best with its business practices while propelling their sustainability journey forward. Our experience working with over 400 investors and engaging with more than 3,000 corporate companies uniquely positions us to grasp the diverse incentives and information requirements of stakeholders across jurisdictions, allowing us to offer a nuanced understanding of this decision-making process.

A unique combination: Data management and analysis

Once companies have chosen the compliance route and selected the framework that best suits them, they will need to begin the process of collecting and analysing sustainability-related data. Although this might seem straightforward, each reporting standard focuses on very different and ambitious information requirements. Under TCFD alone, for example, companies must make both quantitative disclosures (e.g., carbon footprint, climate risk related metrics associated with water, energy, or waste management) and qualitative disclosures (e.g., description of governance systems, identification of physical and transition risks).

Therefore, at this stage, it becomes crucial to establish a data infrastructure that enables the management of information in an automated, and flexible system. This is the only way for in-scope entities to achieve the disclosure of transparent, authentic, and integral ESG-related information. Our platform is designed with these goals in mind, providing tailored solutions that allow our clients to navigate the landscape of ESG governance, in tandem with an outstanding team of sustainability advisory experts.

Following the global trend, the UAE’s ESG Disclosures Framework is set to reshape the way companies and financial entities collect and communicate sustainability-related information.

At Holtara, we are convinced that this milestone will not only elevate standards but also transform business practices across the region by promoting good practices. We are excited to support our clients on this transformative journey, helping them lead the way in sustainable business excellence.

Holtara's offering

Since 2023, companies and fund or asset managers registered in the Abu Dhabi Global Market (ADGM) are set to start disclosing ESG-related information.

At Holtara, we are prepared to support our clients navigate this journey, with a range of services that fully cover the reporting process:

Comply or explain. In-scope entities can comply with ADGM's ESG Disclosure Framework or provide an explanation for their decision not to do so. Holtara can help communicate this decision to regulators as companies set up the necessary infrastructure for future compliance.

Choice between standards. In-scope entities can select the most relevant global reporting standard. Holtara can assist in this selection process, by understanding each company's unique business practice and conducting thorough gap analysis to identify the best fit.

Data management and analysis. Entities opting to comply must then kickstart a comprehensive data collection process, perform detailed analysis, monitor progress, and set strategic goals and targets. Holtara's integrated advisory services and technological platform provide best in class streamlined solutions to facilitate this process.