Why nature matters to business

Nature’s ecosystem services are vital to the functioning of the global economy. In fact, around 50% of the world’s GDP depends directly on nature (World Economic Forum, 2020). Sectors such as agriculture, food, and construction are particularly vulnerable, with many industries relying on natural resources and healthy ecosystems. Nature-related risks are becoming increasingly apparent, with disruptions to these systems potentially jeopardising business operations and supply chains. For example, industries dependent on crop production or clean water can be severely affected by ecosystem degradation or climate change.

In response, financial institutions are beginning to recognise the importance of addressing nature-related risks. Many are engaging with clients to assess the impact of biodiversity and natural capital on their portfolios. With climate change already firmly in the spotlight, nature and biodiversity are rapidly emerging as critical issues in the financial sector.

The rise of regulatory focus

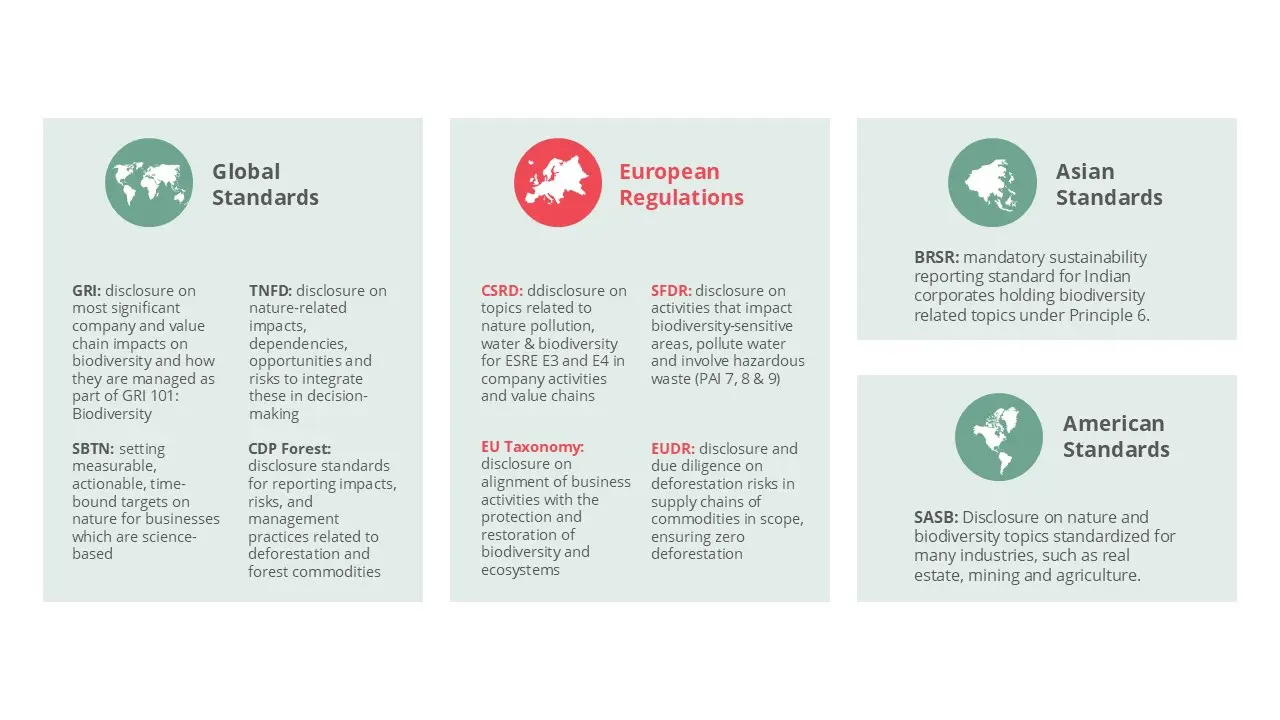

Regulation is increasingly shifting towards addressing nature-related risks. The Taskforce on Nature-related Financial Disclosures (“TNFD”), a global reporting standard aiming to simplify and structure nature-based reporting for corporate and financial institutions, has seen sharp acceleration of adoption in 2024, with 57% signatory growth since January, of which 129 are financial institutions with 17.7 trillion USD in assets under management (TNFD, 2024). Another initiative, the Finance for Biodiversity pledge, launched in 2020, now has almost 200 members with over 20 trillion euros of assets under management (Finance for Biodiversity Foundation, 2024).

The European Union has already incorporated nature into its recent regulations, such as the Corporate Sustainability Reporting Directive (“CSRD”) and the EU Taxonomy. These regulatory measures follow the success of climate-related policies and aim to provide a clear path for companies to understand and report their impact on nature.

The rise of these frameworks signals a growing need for businesses to take nature-related risks seriously, not just from an environmental standpoint, but also from a financial one. Companies that fail to consider these risks may find themselves exposed to reputational damage, legal liabilities, and supply chain disruptions.